In today's dynamic economic climate, efficiently managing your finances is paramount. Essential part of this process involves implementing sound tax accounting solutions. By optimizing your tax strategy, you can reduce your tax liability and enhance your financial well-being. A skilled tax accountant can advise you in navigating the complexities of tax laws and uncovering opportunities to conserve valuable assets.

- Expert tax planning can reveal hidden deductions and credits, substantially reducing your overall tax burden.

- Additionally, proactive tax management promotes compliance with ever-changing regulations, securing you from potential penalties.

- By collaborating with a trusted tax accountant, you can achieve peace of mind knowing that your financial interests are {well-represented|effectively managed|adequately protected>.

Precise Bookkeeping for Effortless Operations

Accurate bookkeeping is the core of any prosperous business. It offers a detailed picture of your financial health, enabling you to make informed decisions. By carefully recording every deal, you can observe your revenue and outlays, discovering areas where you can optimize your efficiency.

A systematic bookkeeping system simplifies operations, minimizing the risk of mistakes. This, in turn, reinforces your {financialstability, allowing you to devote your time and energy to expansion.

Ultimately, accurate bookkeeping is an essential investment for any business that aims sustainable success.

Unlocking Potential with a Fractional CFO

As your enterprise scales, the demand for robust financial management grows. A dedicated Chief Financial Officer (CFO) is often essential to navigate obstacles, but a full-time commitment may not be feasible. This enters the scene for fractional CFO expertise.

A fractional CFO provides proactive financial management on a as-needed basis. They bring invaluable insights to help your business attain its revenue objectives.

- Their expertise extends to {developing and implementing a sound financial plan, optimizing cash flow, securing funding, and making data-driven decisions.

- Fractional CFOs also provide

- By utilizing fractional CFO expertise, you can gain a significant financial advantage.

{valuable industry knowledge and insights, helping you to stay ahead of the curve.

Venturing into Business Formation with Ease

Forming a business is a thrilling undertaking, but it doesn't have to be tedious. With the proper guidance and resources, you can traverse this process with simplicity. Start by defining your business concept and conducting thorough market analysis. Develop a comprehensive business blueprint that outlines your goals, target audience, and revenue projections.

Secure the necessary funding through loans, and create a legal entity that suits your needs. Remember to comply with all applicable laws.

Leverage the expertise of consultants to optimize the process and guarantee a smooth launch. Stay structured, communicate effectively, and commemorate your progress along the way.

Establishing Your Company Structure and Setup

Launching a new venture is an exciting endeavor, but navigating the complexities of company structure and setup can feel overwhelming. Seeking expert guidance throughout this process Keep Going Forward is crucial in ensuring a strong foundation for your business. A seasoned professional holds invaluable expertise on legal requirements, tax implications, and operational best practices, helping you make informed decisions that align with your long-term goals.

Firstly, an expert can assist you in choosing the most appropriate legal structure for your company, such as a sole proprietorship, partnership, LLC, or corporation. Each structure possesses unique advantages and drawbacks, and an expert can help you assess these factors based on your specific needs.

Furthermore, expert guidance includes assistance with registering your company, obtaining necessary licenses and permits, and implementing sound financial and operational systems. By utilizing the expertise of a professional, you can simplify the setup process, minimize potential risks, and set your company on a path to success.

Financial Clarity Through Tailored Services

In today's dynamic financial landscape, achieving clarity and mastery over your finances can feel like an overwhelming challenge. That's where tailored services come in. By offering unique plans and approaches, we empower you to navigate the complexities of personal finance with ease. Our team of knowledgeable professionals takes the time to assess your specific financial objectives and formulate a roadmap that aligns with your needs.

- Revel in the perks of having a defined financial plan.

- Minimize stress and doubt by gaining financial stability.

- Take informed choices about your finances with greater insight.

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Richard Thomas Then & Now!

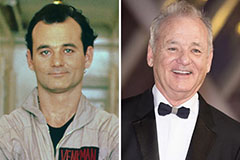

Richard Thomas Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!